In today's competitive financial landscape, professionals require strategic wealth management approaches. To maximize your {financialwell-being, it's crucial to {implement|adopt a multifaceted strategy that encompasses asset allocation, risk management, and estate planning.

- A well-defined financial plan should serve as a guidepost for your future {financialaspirations.

- evaluate your financial strategy to ensure it remains consistent with your evolving circumstances.

- {Explore|Delve into a diversified portfolio of assets, including stocks, fixed income, and private equity.

Develop a strong alliance with a experienced financial advisor who can provide personalized guidance based on your unique financial situation.

Crafting Financial Planning Blueprint for your Successful Career

Securing a successful career path often involves more than just honing your abilities. It also requires thoughtful financial planning to ensure you're ready to navigate the challenges and advancements that lie ahead. A robust financial blueprint can serve as a roadmap , helping you distribute your resources wisely, mitigate financial risks, and ultimately financial planning for professionals achieve your long-term career objectives.

Initiating with a clear understanding of your current financial position is crucial. Analyze your income, expenses, assets, and debts to gain a comprehensive picture of your financial health. Subsequently , set realistic financial goals that are in harmony with your career trajectory . These goals could include saving for retirement, acquiring a home, or funding your professional development .

- Explore various investment vehicles that align with your risk tolerance and financial goals.

- Spread your portfolio across different asset classes to reduce risk.

- Engage professional financial advice from a certified planner to create a personalized plan that meets your unique needs.

By executing a well-defined financial planning blueprint, you can set yourself up for long-term career success and economic security.

Preserving Your Success: Custom Financial Guidance for Elite Individuals

As a high earner, you've achieved significant victory. But your journey isn't over. Building lasting wealth requires a sophisticated approach tailored to your unique objectives. Our expert team crafts personalized financial plans that address your distinct needs, whether it's maximizing capitalization, mitigating risk, or intelligently planning for the future.

- We analyze your current financial status.

- Craft a comprehensive plan aligned with your dreams.

- Deploy solutions to enhance your wealth.

- Monitor your progress and modify as needed to achieve your goals.

Let us help you secure your future. Connect with us today for a complimentary consultation.

Cultivating and Developing Your Professional Wealth

While a competitive salary is crucial, true financial success extends beyond your paycheck. To build lasting wealth, consider augmenting your income streams by leveraging opportunities for professional advancement. This could involve enhancing in-demand skills, fostering relationships, or even creating your own ventures. Remember, a focused strategy towards your career can yield substantial rewards throughout your professional journey.

- Proactively distribute time and resources into skill development

- Cultivate a professional network through engagement

- Continuously evaluate your career trajectory and adapt your goals as needed

Master Your Finances Like an Expert: A Guide for Professionals

Your career success hinges heavily/significantly/strongly on your financial acumen. Like a skilled strategist/operator/pilot, you need to analyze/evaluate/monitor your income, expenses, and investments wisely/effectively/proactively. This means developing/implementing/crafting a comprehensive financial/spending/budgeting plan that optimizes/maximizes/streamlines your resources.

Create/Build/Establish healthy spending/saving/investment habits to secure your future. Leverage/Utilize/Employ tools/resources/strategies such as budgeting apps, retirement/insurance/investment advisors, and financial/economic/market education to enhance/improve/boost your financial literacy. Remember, proactive financial management is an ongoing process that requires/demands/necessitates consistent attention and adaptation/adjustment/modification.

Securing Financial Independence: Smart Planning for Professional Success

Financial independence is a coveted goal for many professionals. It represents the ability to achieve your dreams and live life on your own specifications. To get there, smart planning is essential. This involves setting clear budgetary goals, creating a budget that functions for you, and implementing informed capital growth decisions.

A key element of financial planning is diversification. Don't put all your eggs in one fund. Explore different strategy avenues to mitigate risk and enhance potential returns.

Periodically review your plan and make modifications as needed based on your evolving circumstances and market conditions. Remember, financial independence is a journey, not a destination. It requires dedication, patience, and a willingness to learn and adapt along the way.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Bill Murray Then & Now!

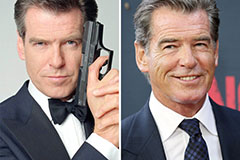

Bill Murray Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!